Cit Bank Joint Account: Embark on a journey of shared financial prosperity. A Cit Bank joint account transcends mere banking; it’s a sacred union of resources, a collaborative path toward collective abundance. Whether it’s a joint checking account for streamlined household management or a joint savings account for shared future goals, this partnership reflects a deeper connection, a synergy of intentions.

Discover how this powerful tool can amplify your financial well-being and deepen your bonds.

This exploration delves into the multifaceted aspects of Cit Bank joint accounts, illuminating the process of opening an account, navigating its features, understanding the legal ramifications of joint ownership, and ensuring the security of your shared financial sanctuary. We’ll uncover the practical steps, explore the diverse account types, and illuminate the path towards harmonious financial management.

Cit Bank Joint Accounts: A Comprehensive Guide

Source: slidesdocs.com

Navigating the world of joint banking can feel like venturing into uncharted territory. This guide aims to illuminate the path, providing a clear and concise understanding of Cit Bank’s joint account offerings, from account opening to security measures. We’ll unravel the intricacies of joint ownership, explore the features and functionality, and address common concerns, ensuring a smooth and informed experience for prospective and existing joint account holders.

Cit Bank Joint Account Overview

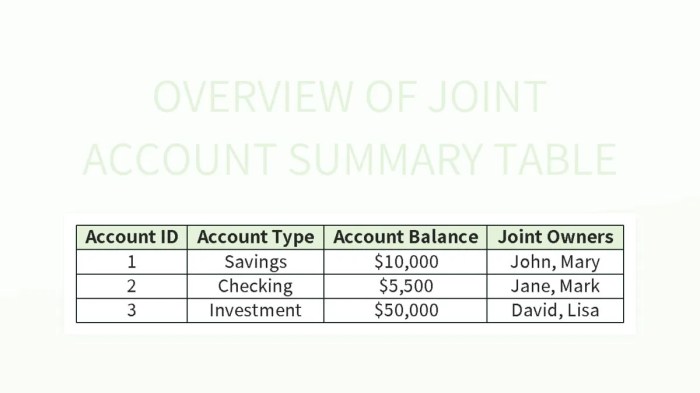

A Cit Bank joint account allows two or more individuals to share ownership and access to a single checking or savings account. This collaborative approach simplifies financial management for couples, families, or business partners. Cit Bank offers both joint checking and joint savings accounts, each tailored to specific needs and financial goals.

The primary benefit of a Cit Bank joint account lies in its convenience and shared responsibility. Managing finances becomes more efficient, allowing for seamless collaboration on expenses, savings, and bill payments. Furthermore, it offers a layer of security, providing multiple authorized users to access funds in case of emergencies or unforeseen circumstances.

Account Opening Process, Cit bank joint account

Opening a Cit Bank joint account online is a straightforward process. It requires the participation of all intended account holders and adherence to specific documentation requirements. Adding a joint account holder after the initial account setup is also a relatively simple procedure, ensuring flexibility and ease of management.

- Visit the Cit Bank website and locate the “Open an Account” section.

- Select “Joint Account” and choose the desired account type (checking or savings).

- Provide the required personal information for all joint account holders, including full names, addresses, Social Security numbers, and date of births.

- Upload the necessary documentation, such as government-issued identification and proof of address.

- Agree to the terms and conditions and submit the application.

- Cit Bank will review the application and notify you of the account approval.

- Once approved, you can access and manage your joint account online or through the mobile app.

Account Features and Functionality

Cit Bank’s joint checking and savings accounts offer a range of features designed for ease of use and collaborative financial management. Online banking tools and mobile app functionalities provide convenient access to account information, transaction history, and account management tools. Access permissions can be customized to meet the specific needs of each joint account holder.

| Account Type | Interest Rate (APY) | Monthly Fees | Minimum Balance |

|---|---|---|---|

| Joint Checking | 0.01% (example) | $0 (example) | $0 (example) |

| Joint Savings | 0.05% (example) | $0 (example) | $100 (example) |

Note: Interest rates, fees, and minimum balance requirements are subject to change and may vary based on account type and promotional offers.

Account Management and Transactions

Source: bankbonus.com

Managing a Cit Bank joint account is streamlined through various convenient methods. Deposits and withdrawals can be made through various channels, including online banking, mobile app, ATM, and in-person at a branch (if applicable). Funds can be easily transferred between the joint account and other accounts held with Cit Bank or other financial institutions.

Making a rent payment from the joint account: Both account holders can authorize the transaction, ensuring transparency and accountability.

Transferring funds to a child’s college savings account: One account holder can initiate the transfer, while the other can review the transaction history for verification.

Paying a shared utility bill: Both account holders can monitor the account balance and ensure sufficient funds are available for the payment.

Joint Account Ownership and Legal Aspects

Understanding the legal aspects of joint ownership is crucial. Cit Bank joint accounts can be structured as joint tenants with the right of survivorship (JTWROS) or tenants in common (TIC). JTWROS grants the surviving account holder full ownership upon the death of another holder, while TIC allows for individual ownership shares and distribution according to a will or trust.

Closing a Cit Bank joint account typically requires the consent of all joint account holders. The process involves submitting a closure request through online banking, mobile app, or by contacting customer service.

Customer Service and Support

Cit Bank provides multiple channels for customer support, ensuring convenient access to assistance for joint account holders. Contact information includes phone numbers, email addresses, and online help resources.

- Phone Support: 1-800-XXX-XXXX (example)

- Email Support: [email protected] (example)

- Online Help Center: [link to help center – example only, do not create a link]

Frequently Asked Questions (FAQs) are readily available on the Cit Bank website, addressing common inquiries regarding joint accounts.

So, you’re thinking about a CIT Bank joint account, eh? Makes sense, sharing the duit is always better than fighting over it, kan? But before you go all willy-nilly, you’ll need to know the CIT Bank SWIFT code for international transfers – you don’t want your money doing the leyeh-leyeh around the world, do ya?

Getting that SWIFT code sorted out is crucial for smooth sailing with your new CIT Bank joint account.

Security and Fraud Prevention

Cit Bank employs robust security measures to protect joint accounts from unauthorized access and fraudulent activities. These measures include encryption technology, multi-factor authentication, and fraud monitoring systems.

Reporting fraudulent activity should be done immediately through the designated channels, such as phone or online reporting tools. Regularly reviewing account statements and monitoring transactions can help detect suspicious activity early on. Strong passwords, regular password changes, and avoiding phishing scams are crucial for maintaining account security.

Examples of security threats include phishing emails attempting to steal login credentials, malware infecting devices used to access online banking, and unauthorized access attempts through compromised passwords. Mitigation strategies include using strong, unique passwords, enabling multi-factor authentication, regularly updating software and antivirus programs, and being wary of suspicious emails and websites.

Conclusive Thoughts: Cit Bank Joint Account

As we conclude our exploration of Cit Bank joint accounts, remember that this is more than just a financial instrument; it’s a reflection of shared values, a testament to collaborative growth. By understanding the nuances of joint ownership, leveraging the available tools, and prioritizing security, you can transform your shared finances into a source of strength, stability, and lasting prosperity.

May this journey towards financial harmony bring you closer together, enriching your lives in ways that extend far beyond the balance sheet.