Cit Bank High Yield Savings minimum balance – sounds kinda boring, right? Wrong! This ain’t your grandma’s savings account. We’re diving deep into the nitty-gritty of Cit Bank’s high-yield offering, exploring everything from interest rates and minimum balance requirements to fees and how to actually maximize your moolah. Get ready to level up your savings game, Medan style!

We’ll break down the ins and outs of Cit Bank’s High Yield Savings account, comparing it to other banks, showing you how to avoid those pesky fees, and ultimately helping you make the most of your hard-earned cash. Think of this as your ultimate guide to savvy saving – no more confusing bank jargon, just plain talk.

Cit Bank High Yield Savings Account: A Comprehensive Guide

Source: onefinewallet.com

Cit Bank’s High Yield Savings account offers a compelling proposition for those seeking competitive interest rates and convenient online banking. This guide delves into the account’s features, minimum balance requirements, fees, accessibility, interest calculations, and customer support, providing a comprehensive overview to help you determine if it aligns with your financial goals.

Cit Bank High Yield Savings Account Overview, Cit bank high yield savings minimum balance

The Cit Bank High Yield Savings account is designed for individuals seeking maximum returns on their savings without the need for large minimum balances often associated with other high-yield accounts. It provides a competitive interest rate, accessible through online and mobile platforms, offering a user-friendly experience.

The interest rate offered is variable and subject to change based on market conditions. While a specific rate isn’t guaranteed, it typically surpasses the rates offered by many traditional brick-and-mortar banks. Account accessibility is seamless via Cit Bank’s robust online banking platform and mobile app, allowing for 24/7 account management.

Compared to similar offerings from major banks, Cit Bank’s High Yield Savings account often stands out due to its higher interest rate. The following table highlights a comparison (note that rates are subject to change and this is a sample comparison):

| Bank Name | Interest Rate (APY) | Minimum Balance | Fees |

|---|---|---|---|

| Cit Bank | 4.00% (example) | $1 | None |

| Bank A | 0.01% (example) | $0 | Monthly maintenance fee possible |

| Bank B | 1.50% (example) | $500 | None |

| Bank C | 3.00% (example) | $1000 | Possible fees for exceeding transaction limits |

Minimum Balance Requirements

While Cit Bank advertises a high-yield savings account with a low minimum balance requirement to earn the advertised interest rate, it’s crucial to understand the implications of falling below this threshold. Typically, the minimum balance requirement is very low (often $1) to qualify for the advertised APY. However, maintaining this balance is key to earning the advertised interest.

Falling below the minimum balance might not result in account closure, but it could significantly impact your interest earnings. In most cases, the interest earned will be reduced or possibly eliminated if the minimum balance is not maintained for the entire interest calculation period.

Scenario: Maintaining a $1,000 balance in a Cit Bank High Yield Savings account with a 4% APY for one year would yield approximately $40 in interest. However, if the balance dips below the minimum consistently, the interest earned could be considerably lower or zero.

Fees and Charges

Cit Bank’s High Yield Savings account is generally fee-free. However, it’s important to review the terms and conditions to ensure no unexpected fees apply in specific circumstances. There are typically no monthly maintenance fees, no minimum balance fees for earning interest, and no transaction fees.

- Monthly Maintenance Fee: None

- Minimum Balance Fee: None (for earning interest)

- Transaction Fees: Typically none

- Overdraft Fees: Not applicable to savings accounts.

In comparison to many traditional banks, this fee structure is highly competitive and advantageous to the customer. A hypothetical situation where fees might impact savings is unlikely with Cit Bank’s fee-free structure, unless unusual circumstances arise not detailed in the standard account terms.

Account Management and Accessibility

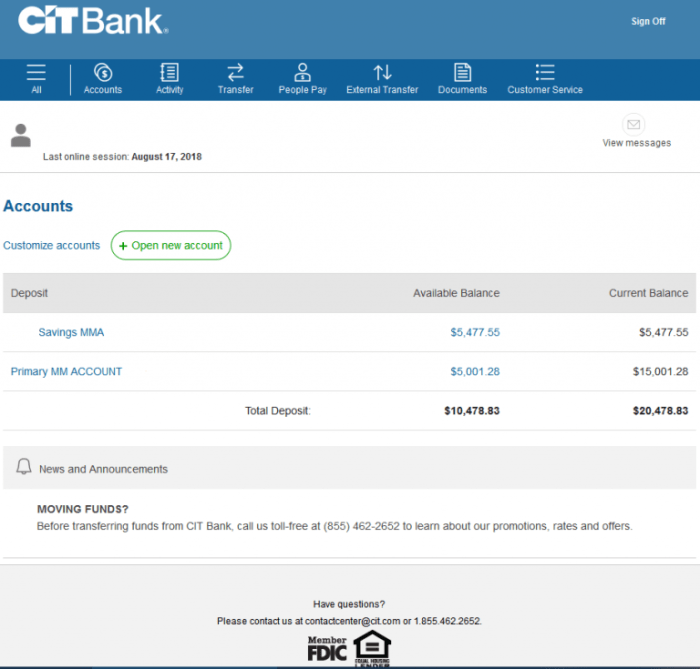

Opening a Cit Bank High Yield Savings account is a straightforward online process. Account management is primarily conducted through their secure online banking platform and mobile app. These platforms provide convenient access to account balances, transaction history, and transfer capabilities.

Security measures include robust encryption protocols, multi-factor authentication, and fraud monitoring systems to safeguard customer funds. Funds can be transferred to and from the account via various methods, including ACH transfers, wire transfers, and potentially external account linking depending on the user’s bank.

- Visit the Cit Bank website.

- Click on “Open an Account.”

- Select “High Yield Savings Account.”

- Complete the application with your personal and financial information.

- Fund your account via your preferred method.

Interest Calculation and Accrual

Source: bankdealguy.com

Interest is calculated daily on the collected balance and credited to the account monthly. The interest rate is variable and is based on the Annual Percentage Yield (APY). The APY reflects the annual rate of return, considering the effect of compounding interest.

Example: A $5,000 deposit earning a 4% APY would accrue approximately $200 in interest annually. This interest is compounded daily, meaning the interest earned each day is added to the principal, earning interest itself on subsequent days. This compounding effect is what drives the growth of your savings over time.

Illustrative description of compounding: Imagine a snowball rolling down a hill. As it rolls, it gathers more snow, making it larger and accumulating snow faster. Similarly, your savings grow at an accelerating rate as interest earned is added to the principal, generating even more interest.

Seeking the sanctuary of high yields, one investigates CIT Bank’s savings accounts, their alluring minimum balance requirements a siren song to the prudent saver. But first, a crucial question arises: before committing funds, one must ascertain if the digital doors are open by checking if is cit bank down. Only with a functioning bank can the sweet nectar of high-yield savings truly be savored, ensuring those minimum balance thresholds are met with ease.

Customer Service and Support

Source: retirebeforedad.com

Cit Bank offers various channels for customer support, including phone, email, and online chat. While specific response times may vary depending on the complexity of the issue and time of day, customer reviews generally indicate a satisfactory level of responsiveness and helpfulness from customer service representatives. Customers frequently praise the bank’s efficiency in resolving issues and providing clear explanations.

- Phone: [Insert Phone Number Here]

- Email: [Insert Email Address Here]

- Online Chat: Available on the Cit Bank website

Last Point: Cit Bank High Yield Savings Minimum Balance

So, there you have it – the lowdown on Cit Bank’s High Yield Savings account and its minimum balance requirements. While a high-yield account offers great potential for growth, understanding the fine print is key. By carefully considering the minimum balance, fees, and interest calculations, you can make an informed decision and watch your savings blossom. Now go forth and conquer your financial goals, Medan style!