Cit Bank wire transfer limits are a crucial aspect of understanding how you can utilize their services effectively. This guide explores the various factors influencing these limits, including account type, transaction history, and verification status. We’ll delve into the specifics of domestic and international transfers, clarifying the processes and associated fees. Understanding these limitations empowers you to manage your financial transactions smoothly and efficiently with Cit Bank.

We will examine the different wire transfer limits imposed by Cit Bank, comparing them to industry standards. We’ll also provide a step-by-step guide to initiating transfers, highlighting the necessary information and security measures involved. This comprehensive overview aims to equip you with the knowledge needed to navigate Cit Bank’s wire transfer system confidently.

Cit Bank Wire Transfer Fees and Limits

Source: gobankingrates.com

Understanding Cit Bank’s wire transfer fees and limits is crucial for efficient financial management. This guide provides a comprehensive overview of Cit Bank’s wire transfer policies, covering fees, limits, account types, the transfer process, security measures, international transfers, and troubleshooting common issues.

Cit Bank Wire Transfer Fees, Cit bank wire transfer limit

Source: ira-reviews.com

Cit Bank’s wire transfer fees vary depending on several factors, including the transfer type (domestic or international), the transfer amount, and the recipient type (individual or business). Generally, international transfers incur higher fees than domestic transfers. The exact fees are subject to change, so it’s always best to check the current rates on Cit Bank’s website or by contacting customer service.

Compared to major competitors, Cit Bank’s fees are generally competitive, although specific pricing can vary. It is advisable to compare fees across several banks to find the most cost-effective option for your needs.

| Transfer Type | Amount | Recipient Type | Fee (USD) |

|---|---|---|---|

| Domestic | Under $10,000 | Individual | $25 (Example) |

| Domestic | Over $10,000 | Individual | $35 (Example) |

| International | Under $10,000 | Individual | $50 (Example) |

| International | Over $10,000 | Business | $75 (Example) |

Note: These are example fees and may not reflect current pricing. Please refer to Cit Bank’s official website for the most up-to-date information.

Cit Bank Wire Transfer Limits

Cit Bank imposes daily, weekly, and monthly limits on wire transfers to mitigate risk and ensure the security of its customers’ accounts. These limits vary depending on several factors, including account type, account history, and verification status.

For example, a newly opened account might have lower limits than an established account with a long history of responsible financial activity. Customers with a higher verification status (e.g., those who have provided extensive documentation) may also qualify for higher limits. The process for requesting a limit increase typically involves contacting Cit Bank’s customer service department and providing relevant documentation.

Types of Cit Bank Accounts and Wire Transfer Capabilities

Wire transfer capabilities differ slightly depending on the type of Cit Bank account held. The limits and fees may vary for checking, savings, and business accounts. For instance, business accounts often have higher transfer limits to accommodate the larger transaction volumes typical of businesses.

- Checking Accounts: Typically have standard wire transfer limits and fees.

- Savings Accounts: May have lower limits and potentially higher fees compared to checking accounts.

- Business Accounts: Usually offer higher wire transfer limits and potentially different fee structures to accommodate business needs.

Understanding the Wire Transfer Process at Cit Bank

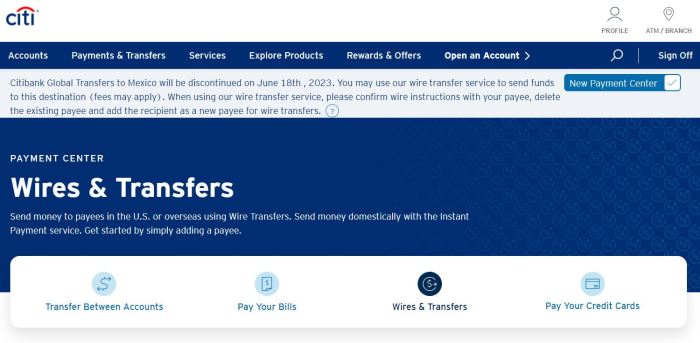

Initiating a wire transfer through Cit Bank’s online banking platform is a relatively straightforward process. The specific steps may vary slightly depending on the type of transfer (domestic or international).

- Log in to your Cit Bank online banking account.

- Navigate to the “Transfers” or “Wire Transfers” section.

- Select “Domestic Wire Transfer” or “International Wire Transfer”.

- Enter the recipient’s banking information (account number, routing number, bank name, etc.).

- Specify the transfer amount.

- Review the details and confirm the transfer.

For domestic transfers, you typically need the recipient’s account number and routing number. International transfers require additional information, such as the recipient’s bank’s SWIFT code and their address. Processing times vary, with domestic transfers usually completing within one business day, while international transfers can take several business days.

Security Measures for Cit Bank Wire Transfers

Cit Bank employs robust security protocols to protect wire transfer transactions from fraud. These measures include multi-factor authentication, encryption, and transaction monitoring.

Understanding CIT Bank’s wire transfer limits is crucial for efficient financial management. If you need clarification on specific limits or encounter issues, contacting CIT Bank directly is recommended. You can reach them by calling the CIT Bank 800 number for assistance. This ensures accurate information regarding your wire transfer limit and any potential restrictions.

The infographic below visually summarizes Cit Bank’s security measures for wire transfers.

Infographic Description: A visually appealing infographic, using a gradient of blues and greens, features a central image of a shielded lock. The lock is depicted with a strong, bold Artikel, emphasizing security. Around the lock, icons representing multi-factor authentication (a phone, a fingerprint), encryption (a padlock), and transaction monitoring (a graph) are displayed. A clear, sans-serif font is used for headings and text.

The layout is clean and uncluttered, ensuring easy readability and understanding.

International Wire Transfers with Cit Bank

Source: accreditloan.com

Initiating an international wire transfer involves similar steps to a domestic transfer, but with the addition of providing more recipient information. This includes the recipient’s bank’s SWIFT code, their full address, and potentially additional documentation depending on the recipient’s country and the transfer amount.

International wire transfers typically incur additional fees and charges compared to domestic transfers, including intermediary bank fees and potential currency conversion fees. These charges can vary depending on the recipient’s bank and the specific countries involved.

Troubleshooting Wire Transfer Issues at Cit Bank

Several common issues can arise during wire transfers. Understanding these issues and their potential solutions can help ensure a smooth and efficient process.

| Issue | Cause | Solution |

|---|---|---|

| Incorrect recipient information | Typographical errors or incorrect account details | Contact Cit Bank customer service immediately to correct the information and initiate a reversal if necessary. |

| Insufficient funds | Insufficient balance in the sending account | Ensure sufficient funds are available in the account before initiating the transfer. |

| Delays | Technical issues, banking holidays, or international regulations | Contact Cit Bank customer service to inquire about the status of the transfer. |

Summary: Cit Bank Wire Transfer Limit

Navigating the world of wire transfers can seem complex, but with a clear understanding of Cit Bank’s policies and procedures, the process becomes significantly more manageable. By understanding your account’s specific limits and the steps involved in initiating a transfer, you can ensure your transactions are processed efficiently and securely. Remember to always verify recipient details and adhere to best practices to avoid potential issues.

This guide serves as a resource to help you confidently manage your financial transactions via Cit Bank’s wire transfer services.